Why should they use valuable time and precious resources for any activity that does not obviously improve the bottom line? A leading CSR scholar proves how it improves a firm’s financial performance.

The answer to the big question is that CSR can, and when done properly, will very likely improve a firm’s financial performance. Companies find that CSR helps to create a bigger marketplace for growth. It attracts better talent. And provides more opportunities for business success. Seen as an investment, giving back to the community through Corporate Social Responsibility is a cost-effective strategy that strengthens a company’s image, and makes it more attractive to three important constituents – investors, customers and employees.

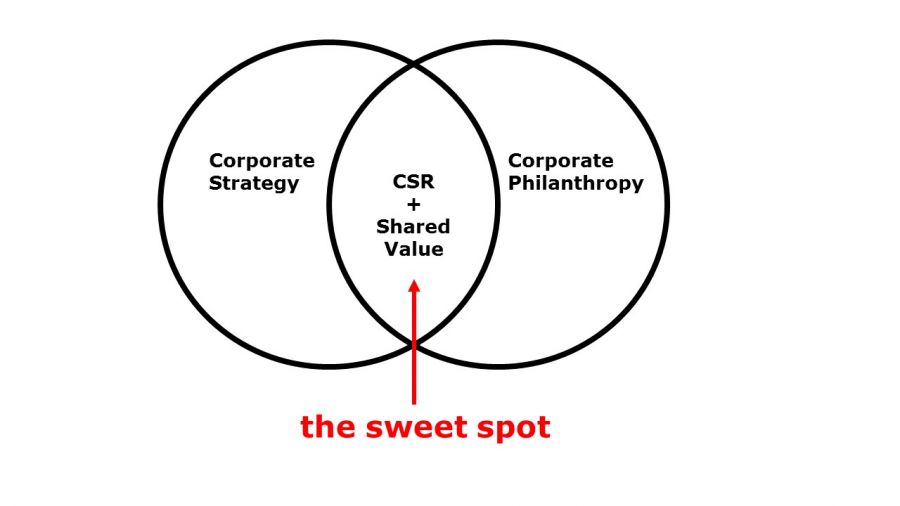

A CSR thought leader explains the “sweet spot”

Peter Frumkim, the Founding Research Director of the Satell Institute and Professor of Social Policy and Faculty Director of the Center for Social Impact Strategy at the University of Pennsylvania conceptualizes the value of CSR by a Venn diagram.

“As the diagram above shows, Corporate Benefits are on one side, meaning what does the activity do for the company. On the other side is Community Benefits, meaning what benefits are available for shareholders around the company. And in the middle, is the sweet spot, the CSR activity. This is the “doing good” activity that leads to the company doing well for itself.”

The “sweet spot” has been expressed in a few ways

1. BLENDED VALUE. This concept is defined in a series of articles by Jed Emerson – a widely recognized international practitioner and thought leader. He argues that firms cannot have a simple definition of VALUE that focuses on just one dimension, such as financial, social or environmental. Rather, he states that the VALUE a company creates is unified as it is blended with all three dimensions.

2. SHARED VALUE. Two other recognized experts in the field Michael Porter and Mark Kramer presented a new diagram shown below. They argue that the overlap here is something big and new, which they termed Shared Value. They claim this is an integral part of a firm’s competitive strategy and orientation. They called for integrating the idea of profit maximization into the concept of shared value.

Today, many companies are ahead of the curve.

They have made many of the transitions Porter and Kramer advocated, such as partnering with nonprofits in causes that hit the “sweet spot”. Engaging in causes that benefit the company and the community enables firms to achieve their strategic goals, and are welcomed by investors, customers and employees.

There are lots of ideas about the value CSR brings to firms. As explained in the Satell Institute’s 8 Guiding Principles, there are opportunities for businesses to serve the community that can be critical to the success of a business. Improving health care, job preparation, youth development and the arts are just a few.

Even during difficult times, Blended Value or Shared Value can serve a company’s self-interest for long-term business success. That is why investors, employees and customers look with increasing favor on the benefits a firm brings to its community. And why more and more companies are engaging in CSR, and including it in their business strategies.